Medicare Supplement Plans, Longview

- Home

- Medicare Supplement Plans

At Thomas Insurance Services, we help choose the best Medicare supplement plans for your evolving healthcare needs and budget.

Get extra Medicare coverage that the Original Medicare plan ( Plan A & Plan B) does not provide with us as your Medicare agents in East Texas.

We take immense pride in our experience of more than 39 years in the Medicare insurance industry. Share your renewed Medicare needs and leave everything to us.

Benefits of Medicare Supplement Plans

Medicare supplement plans ( also known as Medigap plans) compensate for the coverage left by traditional Medicare plans ( Type A and Type B).

Extended Skilled Nursing Facility Coverage

Medigap plans can extend coverage for skilled nursing facility care. This helps you cover additional costs required for extended stays or hospitalization.

Coverage of Medigap

Reduce out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Cut down financial burden for Medicare-covered services.

Freedom to Choose Healthcare Providers

Choose any doctor or specialist who accepts Medicare for their treatment. You do not even need referrals to consult a doctor.

Travel Coverage

Some medigap plans offer coverage for emergency medical expenses incurred while traveling outside the United States.

Comparing Different Medicare Supplement Plans, Longview Texas

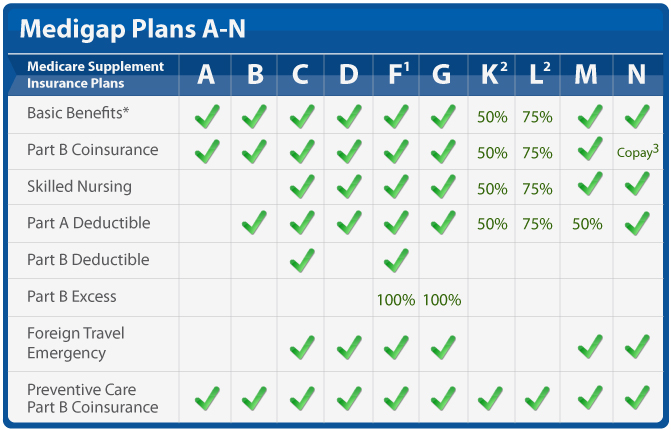

There are several types of Medicare Supplement Plans, designated by a letter (A, B, C, D, F, G, K, L, M, and N). They provide the same benefits regardless of the insurance company.

Here is a quick overview of the common Medigap plans:

- Medigap Plan A:

- Covers basic benefits such as Medicare Part A hospital coinsurance and hospital costs.

- Medigap Plan B:

- In addition to the benefits covered by Plan A, Plan B also covers Medicare Part A deductible.

- Medigap Plan C:

- Receive comprehensive coverage, including coverage for Medicare Part B deductible, skilled nursing facility care coinsurance, and foreign travel emergency care.

- Medigap Plan D:

- Covers Medicare Part A deductible, skilled nursing facility care coinsurance, and foreign travel emergency care.

- Medigap Plan F:

- Covers all the gaps in Medicare coverage, including both the Medicare Part A and Part B deductibles.

- Medigap Plan G:

- Receive comprehensive coverage except the Medicare Part B deductible.

- Medigap Plan K:

- Covers Medicare Part A hospital coinsurance and covers half of Medicare Part B coinsurance.

- Medigap Plan L:

- Covers three-fourth of the Part B coinsurance or copayments.

- Medigap Plan M:

- Get 50% coverage for the Medicare Part A deductible.

- Medigap Plan N:

- Covers the Medicare Part A deductible. However, copayments for office visits and emergency room visits are required.

Look at the Medigap plan comparison chart for more clarity

Which Is The Right Medicare Supplement Insurance Plan?

Medicare Supplement Plans cost

Medicare supplement plans offer the same benefits but the price at which you shop may vary. Typically, insurance companies price the poicies in one of the following three ways:

- Community-rated Medigap Plan: Herein, medicare costs (premium) remain the same for everyone regardless of the person’s age.

- Issue-age rated Medigap Plan: Herein, medicare cost (premium) is calculated based on the age of the person when the plan was purchased.

- Attained-age rated Medigap Plan: Herein, medicare cost (premium) increases as the person ages.

Some insurance companies may offer discounts. Thomas Insurance Services can guide you through different policies that can optimize your Medicare costs without affecting the healthcare services in East Texas.

Eligibility for Medicare Supplement Plans

Eligibility for Medicare supplement plans is ascertained based on a few key criteria.

- Enrollment in Medicare Part A and Part B: Applicants must be enrolled in both Medicare Part A and Part B.

- Age: You can purchase a Medigap plan when you turn 65.

- Medigap Enrollment Period: Enroll during the Medigap Open Enrollment Period. It starts on the first day of the month in which you turn 65 or older and enrolled in Medicare Part B. You have a window of 6 months from that date to enroll in the Medigap plan.

- Not Enrolled in Medicare Advantage: Those who have enrolled in the Medicare Advantage plan can’t pursue Medigap plans.

Thomas Insurance Services can help you enroll in the Medigap plan without any hassle. We lift off the undue stress the elderly take when it comes to managing Medicare in East Texas.

Certified Medigap Insurance Agents, Longview Texas

Thomas Insurance Services effectively address and overcome the Medicare complexities for East Texas residents. Whether buying for the first time or switching existing Medigap plans. We have more than three decades of experience in helping aging Texans secure optimal medical needs in their budget.

Share what’s on your mind and leave everything to our licensed Medicare agents from East Texas.

Frequently Asked Questions

You can buy Medicare supplement insurance plans in the following conditions:

- Seniors 65 years or older

- Medicare Beneficiaries with Medicare Parts A and B (Original Medicare)

- Specialized healthcare needs such as a disability or End-Stage Renal Disease (ESRD)?

Medigap plans typically cover out-of-pocket expenses such as co-insurance, co-payments, and deductibles for Medicare Part A and Part B. Some plans also offer additional benefits, like foreign travel emergency coverage.

No. Medicare Supplement insurance and Medicare Advantage are different types of coverage. Medicare Supplement works with Original Medicare to cover out-of-pocket expenses, while Medicare Advantage plans are an alternative way to receive Medicare benefits through private insurance companies.

In situations when individuals apply outside of the typical Medigap Open Enrollment Period:

- You may have to pay more for a policy.

- Fewer policy options may be available to you.

- The insurance company is allowed to deny you a policy if you don’t meet their medical underwriting requirements.

However, If you possess additional rights such as “guaranteed issue rights” or “Medigap protections”, no insurance company can deny you a Medigap policy. Check with your State Insurance Department today.

The benefits for Medicare Supplement A-N are consistent and do not differ between insurance companies. This means that Plan B from one company provides identical coverage and benefits as Plan B from any other company.

Continue Your Medicare Journey with J.L. Thomas Insurance

The number of Medicare beneficiaries in Texas is reported to be nearly 4.6 million as of June 2023. With the growing healthcare needs and costs, the demand for Medicare supplement policies is likely to rise.

At Thomas Insurance Services, we work with you to understand and purchase extra Medicare coverage that satisfies your evolving Medical needs. Our team will take you through each step, ensuring confidence in your Medicare decisions.

If you or anyone in your family is looking for extra Medicare coverage, we are just a call away to help. We adhere to client confidentiality. So you can entrust the best Medicare insurance team from East Texas.

Contact Us Today

As you have decided to seek extra Medicare coverage, contact us at (903) 353-4204. Our qualified and knowledgeable team is happy to help. From answering your questions to clearing doubts you may have and due diligence.

Texas Medicare can be confusing, but we simplify it for you. We can be your trusted Medicare insurance partner in East Texas. Get professional and personalized Medicare guidance today.